Navigating the Landscape of Income Tax: A Comprehensive Guide to Tax Maps

Related Articles: Navigating the Landscape of Income Tax: A Comprehensive Guide to Tax Maps

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of Income Tax: A Comprehensive Guide to Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Income Tax: A Comprehensive Guide to Tax Maps

Understanding the intricacies of income tax can be daunting, particularly when navigating complex tax systems and varying regulations. An income tax map, however, serves as a valuable tool for individuals and businesses alike, providing a clear and organized visualization of tax rates, brackets, and deductions. This guide delves into the concept of income tax maps, exploring their benefits, components, and practical applications.

The Essence of an Income Tax Map

An income tax map is a visual representation of the tax system, illustrating the relationship between income levels and tax obligations. It typically presents a graphical depiction of tax brackets, showing the corresponding tax rates applicable to different income ranges. Additionally, it may incorporate information on deductions, credits, and exemptions, providing a comprehensive overview of the tax landscape.

Benefits of Utilizing an Income Tax Map

-

Clarity and Understanding: Income tax maps present complex tax information in a clear and concise manner, making it easier for individuals to grasp the structure of the tax system and its impact on their financial situation.

-

Tax Planning and Optimization: By visualizing tax brackets and deductions, individuals can identify potential strategies to minimize their tax liability. This may involve adjusting income levels, utilizing available deductions, or exploring tax-efficient investment options.

-

Informed Decision-Making: Understanding the tax implications of various financial decisions becomes easier with an income tax map. Individuals can make informed choices regarding investments, income generation, and spending patterns, considering the tax consequences.

-

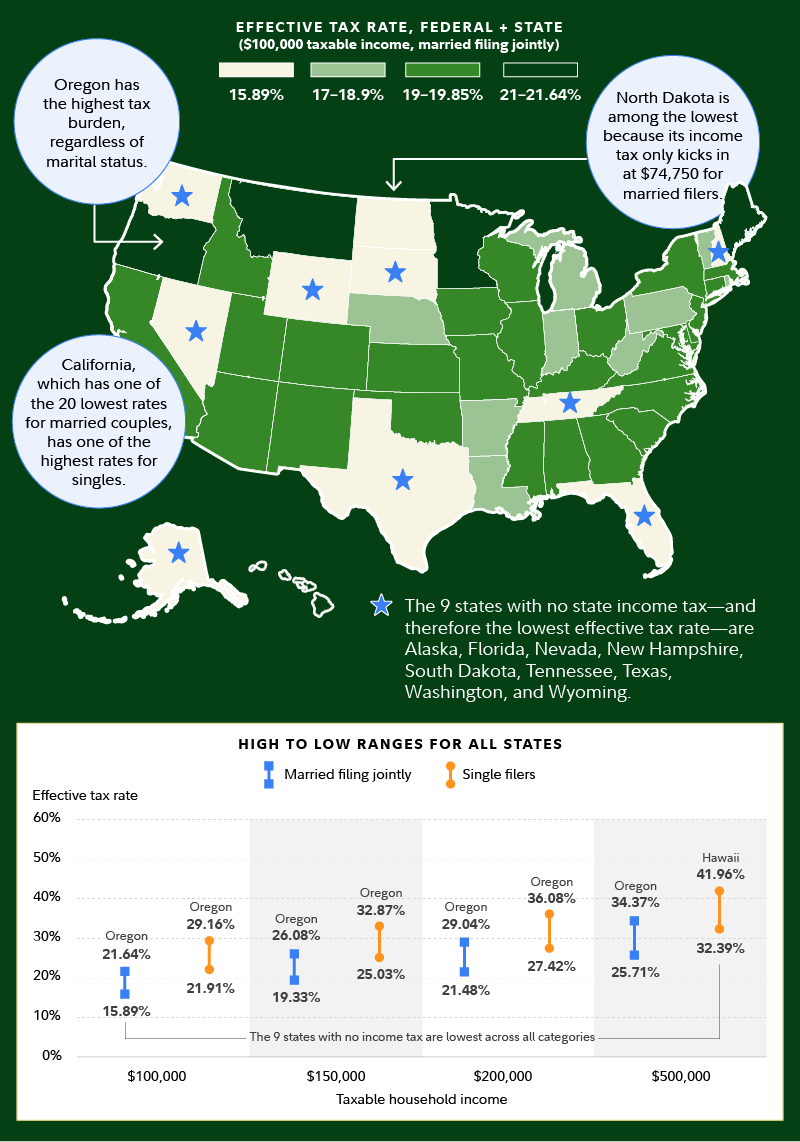

Comparative Analysis: Income tax maps allow for comparisons across different jurisdictions or tax years, providing insights into tax rate changes and potential tax advantages or disadvantages.

Components of an Income Tax Map

-

Tax Brackets: These represent different income ranges, each with its own corresponding tax rate. Income tax maps typically depict these brackets graphically, illustrating the progressive nature of tax systems where higher income levels attract higher tax rates.

-

Tax Rates: The percentage of income that is taxed at each bracket is clearly displayed on the map. This allows individuals to understand the tax liability associated with their income level.

-

Deductions and Credits: Information on available deductions and credits is often incorporated into the map. This includes details on eligibility criteria, calculation methods, and potential benefits.

-

Exemptions: These represent income amounts that are not subject to taxation, such as personal exemptions or exemptions for specific income sources. The map may indicate these exemptions within the relevant income brackets.

Types of Income Tax Maps

-

Basic Tax Maps: These provide a general overview of the tax system, focusing on tax brackets and rates. They are useful for understanding the basic structure of the tax system but may lack detailed information on deductions and credits.

-

Interactive Tax Maps: These offer more comprehensive information, allowing users to input their income and other relevant details to calculate their tax liability. They often include features for exploring different deductions and credits, providing personalized tax calculations.

-

Specialized Tax Maps: These are tailored to specific industries or demographics, such as maps for small businesses, self-employed individuals, or retirees. They highlight tax regulations and incentives relevant to the target audience.

Applications of Income Tax Maps

-

Personal Tax Planning: Individuals can use income tax maps to understand their tax obligations, identify potential deductions and credits, and optimize their tax strategies.

-

Business Tax Planning: Companies can utilize tax maps to assess the tax implications of different business decisions, such as investments, expansion plans, and compensation strategies.

-

Financial Education: Income tax maps serve as effective educational tools, helping individuals and businesses understand the tax system and its impact on their financial well-being.

-

Policy Analysis: Policymakers can use tax maps to analyze the impact of proposed tax changes on different income groups and industries.

FAQs on Income Tax Maps

Q1: How do I find an income tax map for my country or region?

A1: Many government websites, tax preparation services, and financial institutions provide income tax maps or resources that illustrate the tax system. You can search online using keywords like "income tax map" followed by your specific country or region.

Q2: Are income tax maps accurate and up-to-date?

A2: The accuracy and timeliness of income tax maps depend on the source and frequency of updates. It is essential to verify the information with official government resources or reputable tax professionals.

Q3: What if I need help understanding a specific tax deduction or credit?

A3: Income tax maps often provide basic information on deductions and credits. However, for detailed guidance and personalized advice, consult with a qualified tax advisor.

Q4: Can I use an income tax map to prepare my tax return?

A4: Income tax maps can provide valuable insights, but they are not substitutes for professional tax preparation services. It is crucial to consult with a tax professional to ensure accurate and compliant tax filing.

Tips for Utilizing Income Tax Maps

-

Choose a Reliable Source: Select income tax maps from reputable sources, such as government websites, established financial institutions, or tax preparation services.

-

Understand the Scope: Be aware of the specific jurisdiction and tax year covered by the map.

-

Consider Your Individual Circumstances: Income tax maps provide general information. Tailor the information to your specific income level, deductions, and credits.

-

Seek Professional Advice: For complex tax situations or personalized guidance, consult with a qualified tax advisor.

Conclusion

Income tax maps offer a valuable tool for navigating the complexities of the tax system. By providing a visual representation of tax brackets, deductions, and credits, these maps empower individuals and businesses to understand their tax obligations, make informed financial decisions, and optimize their tax strategies. While income tax maps provide a valuable starting point, it is crucial to consult with qualified tax professionals for personalized advice and accurate tax compliance.

.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Income Tax: A Comprehensive Guide to Tax Maps. We thank you for taking the time to read this article. See you in our next article!