Navigating the Landscape: Understanding the Kershaw County Tax Map

Related Articles: Navigating the Landscape: Understanding the Kershaw County Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape: Understanding the Kershaw County Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: Understanding the Kershaw County Tax Map

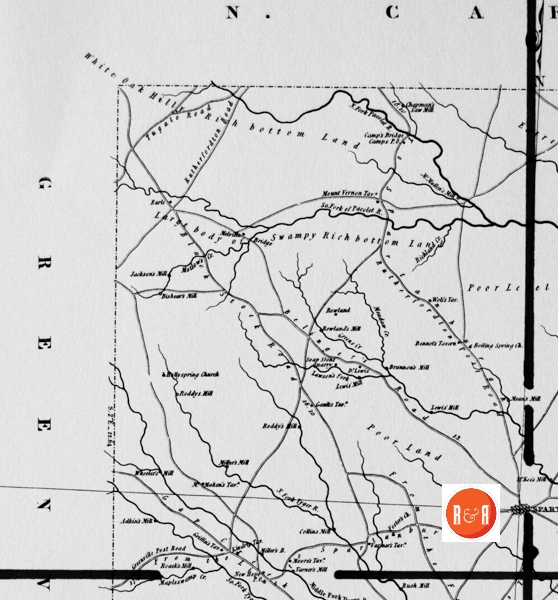

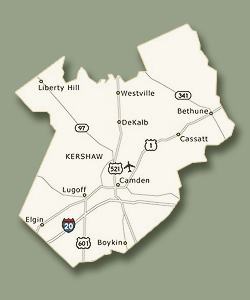

Kershaw County, South Carolina, is home to a diverse array of properties, from bustling urban centers to serene rural landscapes. To effectively manage and assess these properties for tax purposes, the county utilizes a comprehensive tool: the Kershaw County Tax Map. This digital map serves as a vital resource for both residents and government officials, providing a detailed and organized representation of the county’s real estate holdings.

A Visual Representation of Property Ownership

The Kershaw County Tax Map is a digital database that visually depicts the boundaries of every parcel of land within the county. Each parcel is assigned a unique identification number, known as the Tax Map Number (TMN), which acts as its digital address. This number links the parcel to a wealth of information, including:

- Property Owner: The name and contact information of the individual or entity that owns the property.

- Property Address: The physical address of the property, aiding in its accurate location.

- Property Type: The classification of the property, such as residential, commercial, agricultural, or industrial.

- Property Size: The total acreage or square footage of the property.

- Assessment Value: The estimated market value of the property, used to calculate property taxes.

- Tax History: A record of past property tax payments and any outstanding balances.

Navigating the Map: A User-Friendly Interface

The Kershaw County Tax Map is accessible online through the county’s website, providing a user-friendly interface for navigating its vast database. Users can search for specific parcels by TMN, property address, or owner name. The map itself is interactive, allowing users to zoom in and out, view property details, and even print custom reports.

Beyond the Basics: Utilizing the Map’s Potential

While its primary function is to support tax assessment and collection, the Kershaw County Tax Map offers a range of benefits beyond its core purpose.

- Property Research: The map provides a valuable tool for individuals researching properties, whether for potential purchase, investment, or simply for informational purposes.

- Land Planning: Developers, architects, and other professionals can utilize the map to understand property boundaries, zoning regulations, and potential environmental factors.

- Emergency Response: The map’s detailed information aids emergency responders in locating properties quickly and efficiently, potentially saving lives and minimizing property damage.

- Community Development: The map serves as a valuable resource for community development initiatives, providing insights into land use patterns, population density, and potential areas for growth.

Understanding the Importance of Accurate Data

The accuracy of the information presented on the Kershaw County Tax Map is paramount to its effectiveness. Regular updates and maintenance are essential to ensure that the map reflects the current state of property ownership and characteristics. The county actively works to verify and update its data, relying on a combination of internal resources, public records, and feedback from residents and property owners.

FAQs About the Kershaw County Tax Map

1. How do I access the Kershaw County Tax Map?

The map is accessible online through the official Kershaw County website. Look for the "Tax Assessor" or "Property Records" section for the link.

2. What information can I find on the map?

The map provides information on property ownership, address, type, size, assessment value, and tax history.

3. Can I print a copy of a specific property’s information?

Yes, the interactive map allows users to print custom reports containing the details of a selected property.

4. How often is the map updated?

The map is updated periodically, with information being added or modified as property ownership changes or new construction occurs.

5. How can I report an error or discrepancy on the map?

Contact the Kershaw County Tax Assessor’s Office directly to report any inaccuracies.

Tips for Utilizing the Kershaw County Tax Map

- Familiarize yourself with the interface: Take some time to explore the map’s features and functionalities before conducting your research.

- Use the search function: Utilize the search bar to find specific properties by TMN, address, or owner name.

- Zoom in and out: The interactive map allows you to zoom in for a closer look at property boundaries and details.

- Explore the map’s layers: The map often includes additional layers, such as zoning information or aerial imagery, which can provide valuable insights.

- Save your searches: Many online map systems allow users to save their searches for future reference.

Conclusion: A Valuable Resource for All

The Kershaw County Tax Map serves as a vital tool for navigating the county’s complex real estate landscape. Its comprehensive data and user-friendly interface empower residents, businesses, and government officials alike to access valuable information and make informed decisions. By understanding the map’s purpose, features, and benefits, individuals can utilize it to their advantage, contributing to a more informed and prosperous community.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: Understanding the Kershaw County Tax Map. We appreciate your attention to our article. See you in our next article!